A former coal-fired power plant in New York has launched a pilot project using its waste heat to run on-site Bitcoin mining operations. By repurposing excess thermal energy, the facility combines energy efficiency with digital currency production, supporting grid stability and creating new revenue streams. However, this approach faces environmental and regulatory challenges due to emissions concerns. To understand how this innovative reuse impacts energy use and sustainability efforts, keep exploring the details.

Key Takeaways

- The Greenidge Generation plant in New York is repurposing waste heat from its power operations to power Bitcoin mining rigs.

- The facility converts an old coal plant into a hybrid natural gas and crypto mining site, utilizing existing infrastructure.

- Waste heat from cooling systems and flue gases is harnessed to improve energy efficiency and generate additional revenue.

- The project aims to support grid stability and sustainability by combining energy production with digital currency mining.

- Regulatory and environmental concerns are present, with debates over emissions, community impact, and long-term sustainability.

Overview of the Greenidge Generation Initiative

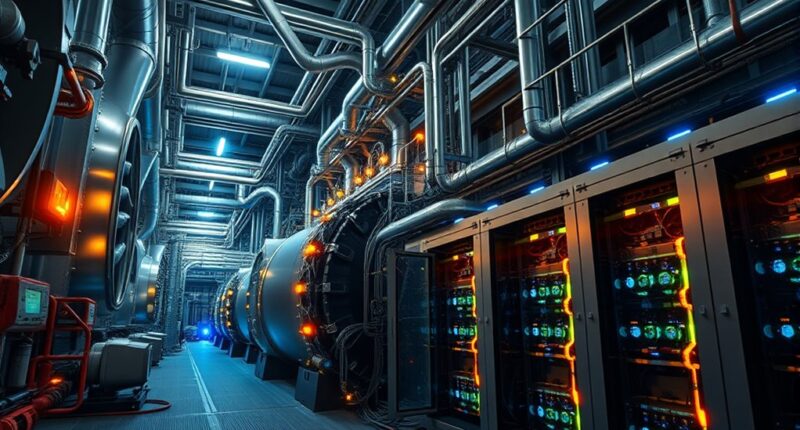

The Greenidge Generation Initiative transforms an old coal-fired power plant in central New York into a hybrid facility that combines natural gas generation with on-site Bitcoin mining. Instead of shutting down, the plant now runs on cleaner natural gas, producing electricity used directly for mining operations. It features over 15,000 computer servers that mine Bitcoin, leveraging the plant’s existing infrastructure. This setup aims to maximize resource use by utilizing the plant’s waste heat, improving efficiency and reducing waste. The project seeks to demonstrate a sustainable approach to crypto mining by integrating energy production with digital currency generation. As a pioneering effort, it blends industrial legacy with modern technology, reflecting a shift toward innovative, on-site energy solutions within the cryptocurrency industry. Incorporating preppy dog names can add a touch of style to the branding and marketing of such environmentally-conscious initiatives.

The Role of Waste Heat in Cryptocurrency Mining

Waste heat from power plants can be harnessed to power cryptocurrency mining, making the process more energy-efficient. By using this heat, miners reduce overall energy consumption and lower environmental impact. This approach offers a practical way to improve sustainability while maximizing resource use. Additionally, integrating high-efficiency projectors into the setup can further optimize energy use and enhance operational performance.

Waste Heat Utilization

Utilizing heat generated from power plants for cryptocurrency mining presents an innovative way to improve energy efficiency. Instead of wasting excess heat, you can repurpose it to keep mining rigs cool while generating revenue. Waste heat can be captured from cooling systems or flue gases and directed to support on-site processes. This approach reduces the need for additional cooling infrastructure, lowering overall energy consumption. In some cases, waste heat is used directly for heating buildings or industrial processes, creating a symbiotic system that maximizes resource use. By harnessing this heat, you not only cut waste but also enhance the environmental profile of mining operations. This strategy turns a byproduct into a valuable asset, helping to mitigate emissions and improve the sustainability of crypto mining. Regular assessment and integration of vertical storage solutions can further optimize space utilization in facilities handling waste heat.

Energy Efficiency Gains

Harnessing waste heat from power plants not only reduces environmental impact but also substantially boosts the energy efficiency of cryptocurrency mining operations. Instead of wasting excess heat, you can repurpose it to power mining rigs, making full use of available energy. This approach minimizes the need for additional power sources and reduces operational costs. By integrating waste heat, you improve overall system efficiency, turning what was once discarded into a valuable resource. Additionally, utilizing waste heat can enhance cybersecurity by reducing reliance on external energy sources that may introduce vulnerabilities.

Environmental Benefits

Using waste heat from power plants for cryptocurrency mining offers significant environmental benefits by reducing overall emissions. Instead of wasting heat that would typically be released into the atmosphere, you turn it into a valuable resource. This process lessens the need for additional energy generation, which often involves burning fossil fuels, therefore lowering greenhouse gas emissions. Recycling waste heat also helps decrease air pollution and mitigates the environmental impact of maintaining traditional cooling systems. By utilizing existing heat, you improve energy efficiency, reducing the carbon footprint of mining operations. Moreover, this approach supports climate goals by making use of otherwise wasted resources, aligning economic activity with environmental sustainability. Overall, harnessing waste heat for mining promotes cleaner, smarter energy use. Additionally, integrating waste heat recovery into AI-driven infrastructure can further optimize energy use and environmental benefits.

Environmental Concerns and Regulatory Challenges

Environmental concerns surrounding on-site crypto mining at fossil fuel power plants have intensified as emissions and air pollution surge dramatically. These operations contribute to higher greenhouse gases, threatening climate goals and public health. Regulatory challenges include delays in permit approvals and legal battles over emissions compliance. You must navigate evolving policies, such as proposed moratoriums and stricter limits on fossil-fuel-based mining. Community opposition, legal rulings, and environmental groups challenge the legitimacy of these projects. Key issues include:

- Rising greenhouse gas emissions from fossil-fuel-powered mining

- Permitting delays and legal challenges

- Conflicts with state climate legislation

- Community protests and opposition

- Increasing regulatory scrutiny and potential bans

These concerns highlight the tension between economic incentives and environmental responsibility, shaping the future of on-site crypto mining.

Economic Motivations Behind On-Site Mining Projects

You likely recognize that excess energy presents a financial opportunity for power plants, making on-site mining an attractive way to monetize waste. By selling or using stranded and curtailment energy, operators can generate revenue without significant additional investment. This strategy transforms idle resources into profit, aligning economic gains with resource optimization. Additionally, leveraging latest technological advancements can improve mining efficiency and profitability.

Profit From Excess Energy

Profit from excess energy has become a key driver for on-site cryptocurrency mining projects, as operators seek to turn waste into revenue. By utilizing surplus power, you can maximize asset value and reduce waste. This approach makes economic sense, especially when energy prices are high or grid demand is low. Additionally, employing best energy efficiency practices can further enhance profitability by minimizing overall energy consumption.

- Turn stranded or curtailed energy into profit

- Reduce costs by using waste heat instead of buying power

- Monetize excess renewable energy during off-peak hours

- Generate additional income from previously unused resources

- Support grid stability by acting as a flexible load

These strategies allow you to capitalize on otherwise wasted energy, improving overall project economics. They also create opportunities for utilities and plant owners to generate revenue without expanding infrastructure.

Asset Monetization Strategies

Asset monetization strategies drive on-site mining projects by transforming underutilized energy assets into revenue streams. You can leverage idle or excess energy, such as waste heat or stranded gas, to power mining rigs, generating income without major capex. These approaches allow plant owners to monetize assets that would otherwise be wasted or inactive, boosting profitability and extending asset lifespan. By partnering with energy producers, you convert otherwise uneconomical resources into valuable digital currency. This creates a steady income from mining, aligning energy output with economic gains. The table below summarizes key asset monetization ideas:

| Asset Type | Monetization Method | Benefits |

|---|---|---|

| Waste heat | On-site mining | Additional revenue, efficiency |

| Stranded gas | Flared gas conversion | Reduced emissions, profit |

| Excess renewable energy | Off-peak mining | Grid stabilization, income |

| Decommissioned plants | Asset reactivation | Extended plant life, cash flow |

| Industrial waste heat | Industrial-mining synergy | Cost savings, sustainability |

Additionally, integrating these monetization methods with renewable energy sources can further enhance sustainability and profitability.

Technological Innovations in Waste Heat Utilization

Innovative technologies are transforming how waste heat from power plants is utilized, especially in the context of cryptocurrency mining. You can now harness excess heat to power nearby buildings, generate additional electricity, or even create district heating systems. These advancements improve energy efficiency and reduce emissions. You might implement heat exchangers that transfer thermal energy directly to mining rigs or develop integrated systems that combine heat recovery with renewable sources. Innovations also include modular heat capture units that retrofit existing infrastructure easily. Smart sensors and automation optimize heat flow, ensuring maximum utilization. By adopting these technologies, you turn waste into valuable resources, lowering costs and environmental impact. Additionally, integrating heat recovery systems with existing power plant infrastructure can significantly enhance overall efficiency.

Community and Industry Responses to the Pilot

Community members and industry stakeholders are actively expressing their reactions to the waste heat-powered Bitcoin mining pilot. Many locals appreciate the potential economic benefits, like job creation and increased tax revenue, especially in a struggling region. However, concerns about environmental impacts dominate discussions. Community groups worry that expanding crypto mining could undermine local climate goals and worsen air quality, citing recent pollution spikes. Industry stakeholders see the project as an innovative way to maximize energy efficiency and support grid stability. Some miners view the pilot as a proof of concept that could attract more investment. Nonetheless, skepticism remains about long-term sustainability and environmental responsibility. Overall, responses are mixed, reflecting both excitement over technological innovation and caution due to environmental and community concerns. Additionally, the project has raised questions about the broader impact of cryptocurrency regulation on local and global efforts to address climate change.

Policy Developments and Future Implications

As policymakers grapple with the rapid growth of crypto mining using waste heat, legislative actions are increasingly shaping the industry’s future. You’ll see proposals like moratoriums on fossil-fuel-powered mining and stricter permit reviews aimed at reducing emissions. States such as New York are considering laws that limit or ban new fossil-fuel mining projects, aligning regulations with climate goals. These measures could slow or halt expansion, especially for operations relying on outdated plants. Expect increased scrutiny on environmental impacts and the push for renewable-powered mining. Policy shifts may also incentivize cleaner energy solutions and integrated industrial-mining strategies. Staying informed about evolving regulations is vital, as they could considerably influence industry growth, operational practices, and the broader energy landscape.

- Moratoriums on fossil-fuel mining projects are gaining traction.

- States are tightening permit requirements for emissions.

- Laws may incentivize renewable-powered crypto mining.

- Regulatory focus shifts toward environmental impact assessments.

- Industry adaptation depends on evolving legal and policy frameworks.

Comparing Fossil-Fuel and Renewable-Powered Mining Strategies

Fossil-fuel-powered mining operations often rely on outdated or stranded plants that can be reactivated to take advantage of existing infrastructure, but this approach comes with significant environmental costs. These plants emit high levels of greenhouse gases and air pollutants, undermining climate goals and local air quality. In contrast, renewable-powered strategies leverage wind, solar, or hydro energy, which produce minimal emissions. Miners using renewables can operate more sustainably and align with climate policies, especially as regulations tighten. Although renewable energy can be intermittent and costly to scale, advancements in energy storage and grid integration improve reliability. By pairing mining with renewables, you reduce environmental impact and support clean energy development, making your operation more resilient and socially responsible in the long run.

Broader Impact on Energy Use and Climate Goals

Using waste heat from power plants for crypto mining considerably impacts overall energy consumption and climate commitments. It can both help and hinder progress toward sustainability goals.

Harnessing waste heat for crypto mining influences energy use and climate goals, offering benefits but also posing risks to sustainability.

- It increases total energy use, potentially conflicting with renewable targets.

- Repurposing waste heat can reduce emissions compared to traditional fossil fuel operations.

- Delaying plant retirements may prolong fossil fuel dependence.

- Mining with excess or stranded energy can support renewable project economics.

- Regulatory responses may tighten, aligning mining practices with climate policies.

Your choices in deploying waste heat for mining influence emissions and energy efficiency. While it offers innovative reuse, it risks expanding fossil fuel reliance if not carefully managed. Balancing economic benefits with climate goals remains essential for sustainable progress.

Frequently Asked Questions

How Much Energy Does the Bitcoin Mining Operation Consume Annually?

You probably want to know how much energy the bitcoin mining operation consumes annually. Based on available data, Greenidge’s mining operation used enough electricity to mine 729 bitcoins in three months, which roughly translates to about 2.4 megawatt-hours per bitcoin. Over a year, this could amount to tens of gigawatt-hours of energy, depending on mining efficiency and operational scale. Keep in mind, exact figures vary with mining activity levels and energy sources.

What Is the Total Greenhouse Gas Reduction From Using Waste Heat?

Using waste heat for bitcoin mining gently shifts the narrative, reducing greenhouse gases by repurposing emissions that would otherwise escape into the atmosphere. While exact figures vary, projects like Greenidge claim significant reductions—potentially hundreds of thousands of tons of CO₂ annually—by utilizing existing thermal energy. This approach not only curtails emissions but also maximizes resource efficiency, helping communities and the environment breathe easier amid ongoing climate challenges.

Are There Plans to Expand or Replicate the Project Elsewhere?

Yes, there are plans to expand or replicate similar projects elsewhere. You’ll find companies and communities exploring waste heat reuse and stranded energy solutions, especially in regions with abundant renewable or excess fossil fuel resources. These initiatives aim to boost local economies and reduce emissions. However, regulatory challenges and environmental concerns may influence their growth, so expect ongoing debates and pilot programs to test the feasibility of wider adoption.

How Does the Project Impact Local Electricity Prices and Grid Stability?

You might notice that such projects can subtly influence local electricity prices and grid stability. By providing flexible, on-site demand, they can help balance supply and reduce strain during peak times. However, increased energy use may also lead to higher costs if demand outpaces supply, potentially causing minor fluctuations. Overall, these initiatives aim to enhance grid efficiency, but their long-term impact depends on broader energy management and policy decisions.

What Measures Are in Place to Ensure Environmental Compliance Long-Term?

You should know that long-term environmental compliance measures include strict permit requirements, ongoing monitoring, and enforcement actions. Regulators review emissions regularly, ensuring companies meet air quality standards and climate laws. Permits can be revoked or denied renewal if violations occur. Community and advocacy groups also hold companies accountable through legal channels. These safeguards aim to minimize environmental impact, but ongoing oversight is essential to maintain compliance and address new challenges.

Conclusion

By harnessing waste heat for bitcoin mining, the Greenidge project shows how fossil fuel plants can boost efficiency and reduce emissions. Did you know that using waste heat could cut cooling energy by up to 90%? This innovation offers a compelling way to balance energy use and crypto growth, but it also highlights the need for responsible regulation. As you watch these developments, remember that smarter energy solutions could help meet our climate goals while fueling new industries.