A Golden Cross happens when the 50-day moving average crosses above the 200-day moving average. This event often signals a potential bullish market, indicating that it may be time to buy. Typically, you'll see increased trading volume accompanying this crossover, which reinforces the buy signal. Historically, the Golden Cross has led to an average price increase of about 20%. While it's a strong indicator, remember it acts as a lagging indicator based on past price movements. To navigate your trading strategy effectively, there's more to explore about its nuances and market implications.

Key Takeaways

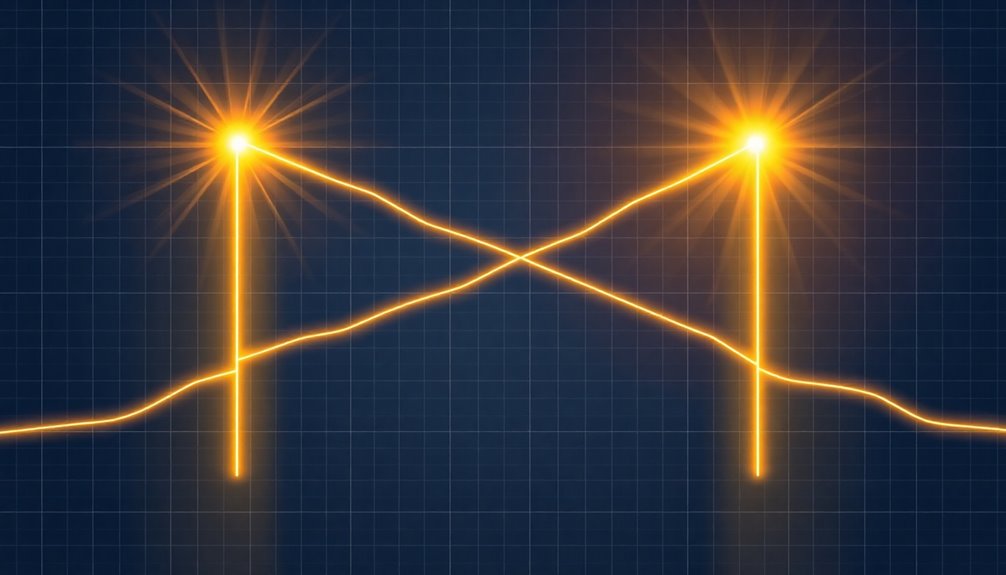

- A Golden Cross occurs when the 50-day moving average crosses above the 200-day moving average, signaling potential bullish market conditions.

- It is considered a definitive buy signal, often leading to significant upward trends in stock prices.

- The crossover is typically accompanied by increased trading volume, reinforcing the bullish signal's reliability.

- While it serves as a lagging indicator, confirmation from other technical indicators is recommended for effective trading strategies.

- Market volatility can lead to false signals, making risk management essential when trading based on a Golden Cross.

Key Characteristics of Golden Cross

The Golden Cross is a powerful bullish signal in the world of trading. It occurs when the 50-day moving average crosses above the 200-day moving average, indicating a potential shift to a bullish market.

This crossover often coincides with increased trading volume, reinforcing the buy signal and investor confidence. Typically, you'll see significant upward price movement following this event, with historical averages suggesting a 20% increase.

The Golden Cross unfolds in three phases: the end of a downtrend, the crossover, and confirmation of an uptrend, where moving averages serve as support levels during corrections.

Enhancing your trading strategy with technical indicators like the Relative Strength Index can further validate the strength of this bullish signal.

Concept Overview and Significance

While many traders focus on immediate price movements, understanding the Golden Cross's concept and significance can enhance your trading strategy.

This phenomenon occurs when a short-term moving average, typically the 50-day MA, crosses above a long-term moving average, usually the 200-day MA, signaling potential bullish market conditions.

Historically, a Golden Cross has preceded significant upward trends, with studies showing average price increases of about 20%. Investors often view this pattern as a definitive buy signal, reflecting strong market sentiment.

However, remember that it's a lagging indicator, meaning it reflects past price movements. To guarantee reliable trading strategies, use confirmation indicators to support your decisions and validate the bullish potential indicated by the Golden Cross.

Signal Crossover Mechanics

When you observe a Golden Cross forming, it's essential to understand the mechanics behind the signal crossover. This occurs when the 50-day moving average crosses above the 200-day moving average, indicating a potential bullish market trend.

It typically marks a shift from a downtrend to an uptrend, driven by increased buying interest. Technical analysts often look for high trading volumes accompanying this crossover, as they reinforce the signal's reliability.

Remember, the Golden Cross is a lagging indicator, reflecting past price movements rather than predicting future behavior.

To enhance your analysis, monitor the distance between the moving averages; wider separations usually suggest stronger trends, helping you make informed trading decisions.

Pros and Cons Analysis

Understanding the pros and cons of the Golden Cross can help you make informed trading decisions. This moving average crossover is widely regarded as a bullish indicator, often signaling significant upward market trends. Many traders use it to inform buy decisions, especially when the 50-day moving average crosses above the 200-day moving average, bolstered by high volume.

However, it's important to recognize that the Golden Cross is a lagging indicator, which means it may not effectively predict future price movements. This can lead to false signals, particularly in volatile markets.

To mitigate risks, employing risk management strategies like stop-loss orders is essential. Additionally, using the Golden Cross alongside other technical indicators can enhance the confirmation of trends and improve trading outcomes.

Golden Cross vs. Other Signals

The Golden Cross stands out as a powerful bullish signal in technical analysis, especially when compared to other indicators like the Death Cross. This bullish signal occurs when the 50-day moving average crosses above the 200-day moving average, indicating potential upward price momentum.

In contrast, the Death Cross signals a bearish market when the 50-day moving average falls below the 200-day. Historically, after a Golden Cross, stock prices have increased by about 20%, making it a strong buy signal. Traders often watch for these crossover points as crucial indicators of potential market shifts. The death cross trading strategy explained involves selling assets or shorting stocks when this signal occurs, as it may indicate a prolonged decline in prices. Investors utilizing this strategy aim to mitigate losses and capitalize on downward trends, reinforcing the importance of moving averages in technical analysis.

While both serve as trend indicators, you can enhance their effectiveness by incorporating additional tools like the Relative Strength Index (RSI) to confirm the strength of these signals and better navigate market conditions.

Market Volatility Impact

Market volatility can greatly affect the reliability of the Golden Cross signal. Sudden price swings can lead to false breakouts or reversals, complicating your trend analysis.

In high volatility, you might notice increased occurrences of whipsaws, where price action fluctuates around moving averages, triggering premature buy or sell signals. This can diminish the Golden Cross's effectiveness as a bullish indicator.

Furthermore, in sideways markets, where price action lacks clear direction, moving averages often converge, making it harder to interpret signals.

External factors like economic news releases or earnings reports can also amplify market volatility, overshadowing the signals the Golden Cross typically provides. Staying aware of these influences is essential for your trading strategy.

Emerging Market Adoption Rates

Emerging markets have shown a remarkable shift toward adopting technical analysis tools, particularly the Golden Cross. This trend is fueled by technological advancements and the rise of online trading platforms, with retail investors increasing by over 200% since the pandemic.

In regions like Southeast Asia and Latin America, over 60% of retail investors utilize moving averages, such as the 50-day and 200-day MA, to enhance their decision-making. A 2022 survey revealed that 45% of traders view the Golden Cross as a key signal for starting long positions.

In addition, educational resources in countries like India and Brazil emphasize the Golden Cross as a fundamental concept, reflecting its growing acceptance in trading strategies among local investors.

Utilize Multiple Timeframes Analysis

When you analyze multiple timeframes, you gain a more nuanced understanding of the Golden Cross and its potential impact on your trading strategy. By examining daily, weekly, and monthly charts, you can assess the strength and persistence of a bullish trend.

A Golden Cross on a longer timeframe often signals a more sustained trend compared to a shorter timeframe. Seeking confirmation across multiple timeframes enhances the reliability of your buy signals, reducing false positives.

This approach helps you identify ideal entry points, allowing you to enter long positions on shorter timeframes after a Golden Cross is confirmed on a longer chart. Historical studies suggest that aligning short-term trades with the overarching long-term trend improves your trading strategies' probability of success.

Frequently Asked Questions

Is a Golden Cross Good or Bad?

A Golden Cross can be seen as a positive signal, indicating a potential upward trend in stock prices.

When you notice one forming, it often suggests increased market confidence and a shift from bearish to bullish sentiment.

However, it's crucial to remember that it's a lagging indicator, meaning it reflects past price movements.

You should always use additional indicators to confirm trends, as false signals can lead to losses.

What Is the Meaning of the Gold Cross?

You might think the term "gold cross" has no real significance, but it actually holds weight in trading circles.

A gold cross signals a bullish trend, occurring when a shorter-term moving average crosses above a longer-term one. This pattern often indicates a potential market upturn, and many traders see it as a strong buying opportunity.

How Do You Predict a Golden Cross?

To predict a Golden Cross, you need to keep an eye on the 50-day moving average as it approaches the 200-day moving average.

Look at historical price data for patterns, and consider using indicators like the RSI or MACD to confirm bullish momentum.

Pay attention to trading volume during the crossover, as increased volume can indicate strong buying interest.

Finally, stay informed about market conditions that could affect your predictions.

What Is the Difference Between the Golden Cross and the Death Cross?

Imagine a race between two runners: the Golden Cross, sprinting ahead with optimism, while the Death Cross lags behind, shrouded in doubt.

The Golden Cross forms when a short-term average overtakes a long-term average, signaling potential gains. In contrast, the Death Cross appears when the short-term average falls below the long-term, hinting at losses.

Each symbolizes market sentiment, guiding your investment decisions with their contrasting messages of hope and caution.

Conclusion

In the world of trading, the golden cross shines like a guiding star, illuminating potential paths to profit. By understanding its mechanics and significance, you can navigate the market seas with confidence. However, keep an eye on the horizon; the winds of volatility can change directions swiftly. Embrace the golden cross, but don't sail alone—consider multiple timeframes and signals to steer your ship toward safer shores and brighter opportunities. Your journey in trading is just beginning.