You can pay your bills with crypto by using crypto-backed debit cards, scanning QR codes for on-chain transactions, or platforms that integrate crypto with open banking. Stablecoins provide a stable way to handle payments without volatility, while blockchain guarantees secure, transparent records. Many services also support cross-border payments, making utility bills faster and cheaper worldwide. If you want to discover the latest platforms and future trends, keep exploring how crypto is transforming bill payments.

Key Takeaways

- Use crypto wallets with QR codes or addresses for direct on-chain utility bill payments.

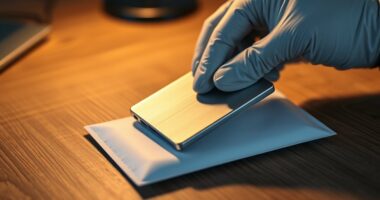

- Opt for crypto-backed debit or credit cards for seamless spending at traditional merchants.

- Pay with stablecoins to minimize volatility risks during bill transactions.

- Utilize platforms combining crypto and open banking for easy fiat-crypto conversions and bill payments.

- Ensure compliance with local regulations and security measures when making crypto payments to bills.

Exploring Crypto Payment Methods for Bill Payments

Have you ever wondered how crypto makes paying bills easier and more efficient? You can pay directly from your wallet by scanning QR codes or copying wallet addresses, making on-chain transactions straightforward. Crypto-backed debit cards also let you spend your crypto at any merchant accepting Mastercard or Visa, converting your digital assets to fiat instantly. Stablecoins are popular because they keep their value pegged to traditional currencies, reducing volatility risk. Some platforms combine crypto with open banking, allowing seamless fiat-crypto conversions for quick on/off-ramping. Additionally, many fintech apps integrate with e-commerce platforms, enabling you to pay bills during checkout. These methods offer flexibility, speed, and security, transforming how you handle everyday payments in a digital economy. Cookies and privacy preferences also play a role in secure online transactions, ensuring your sensitive data remains protected during these processes.

Benefits of Using Cryptocurrency for Utility and Service Bills

Using cryptocurrency to pay utility and service bills offers significant advantages over traditional methods. You can skip banks, reduce fees, and speed up transactions from days to minutes. Blockchain records guarantee transparency, security, and immutability, giving you confidence your payments are correctly logged. Since crypto payments are irreversible, there’s less risk of chargebacks or fraud, protecting merchants and potentially lowering costs for you. Cross-border payments become faster and cheaper, making international utility bills more manageable. Plus, you can pay anytime—day or night—without being limited by banking hours or geographic restrictions. Stablecoins, pegged to fiat currencies, help reduce volatility and ensure predictable payments. Incorporating digital wallets simplifies the process further, allowing seamless management of your crypto funds. Overall, using crypto streamlines bill payments, saving time, lowering costs, and increasing convenience in your financial routine.

Navigating Regulatory and Security Aspects of Crypto Payments

Guiding the regulatory landscape of crypto payments requires careful attention to evolving laws and compliance standards. You need to stay updated on regulations like the GENIUS Act, which mandates stablecoin issuers to hold liquid reserves and provide transparency through monthly disclosures. This guarantees your transactions remain compliant and protected. Crypto payment platforms often operate under licensing requirements, including identity verification, similar to traditional financial services, helping prevent fraud and money laundering. It’s essential to understand jurisdiction-specific rules, as regulations vary across countries and states. Security is equally critical; use platforms with robust encryption, multi-factor authentication, and cold storage solutions to safeguard your assets. Additionally, understanding the safety features of electric heated mattress pads and how they relate to everyday products can provide insight into the importance of security and safety standards across various industries. Staying informed about regulatory developments ensures your crypto bill payments remain secure, legal, and seamless, reducing risks and building trust in your transactions.

Leading Platforms and Infrastructure Supporting Crypto Bill Payments

Leading platforms and infrastructure play a pivotal role in making crypto bill payments seamless and secure. They enable you to pay utility bills, credit cards, and other expenses with ease by offering versatile solutions like crypto gateways, wallets, and payment processors. Platforms such as Shift Markets support a broad range of digital assets, providing smart routing, liquidity, and compliance tools that guarantee safe transactions. Payment providers like Tap offer crypto-backed debit cards, allowing you to spend crypto globally through Mastercard or Visa networks. Payment orchestration systems integrate crypto acceptance across various channels—POS, e-commerce, and mobile apps—creating smooth checkout experiences. These infrastructures reduce friction, lower costs, and enhance security, making crypto bill payments practical for everyday use and supporting wider adoption worldwide. Additionally, understanding the risks associated with merchant services can help users make informed decisions and ensure secure transactions.

Future Trends and Opportunities in Crypto Bill Settlements

As the crypto payments ecosystem evolves, new trends are emerging that will reshape how bill settlements are conducted in the future. You’ll see increased adoption of stablecoins and cross-border crypto payments, making international bill payments faster and cheaper. B2B crypto transactions will become more common, streamlining invoicing and settlement processes for businesses globally. Payment platforms are integrating AI-driven automation to enhance security and efficiency, reducing manual intervention. Underbanked regions will benefit from broader crypto acceptance, promoting financial inclusion. Major players like PayPal are simplifying crypto-to-fiat conversions, making crypto bill payments more seamless. Additionally, regulatory clarity will foster greater merchant adoption, encouraging innovations that reduce costs and eliminate traditional banking limitations. Furthermore, understanding signs of spoilage in perishable goods like lemon juice can help consumers make safer choices, paralleling the importance of reliable, transparent processes in crypto transactions. Overall, these trends will make crypto bill settlements more accessible, reliable, and integrated into everyday financial routines.

Frequently Asked Questions

Can I Pay My Crypto Bills Anonymously?

Yes, you can pay your crypto bills somewhat anonymously, but it depends on the method you choose. On-chain wallet transfers offer more privacy since you just scan QR codes or send directly from your wallet. However, many platforms require identity verification for regulatory compliance, which reduces anonymity. Using privacy-focused cryptocurrencies or mixing services can enhance your privacy, but be aware of legal implications and platform restrictions.

Are Crypto Payments Accepted for Government-Issued Fees?

Yes, crypto payments are accepted for government-issued fees in many countries in 2025. You can pay utility bills, licensing fees, taxes, and other government charges using platforms that support crypto transactions. These platforms often use stablecoins or memecoins for stability. You simply scan QR codes or use wallet addresses, and your payment is processed directly on the blockchain, making it quick, secure, and often cheaper than traditional methods.

What Fees Are Associated With Crypto Bill Payments?

When paying your bills with crypto, you’ll likely encounter transaction fees charged by payment gateways or platforms, which vary depending on the provider and digital asset used. On-chain transfers may have network fees, especially during high traffic periods. Crypto-backed debit cards might include conversion fees or service charges. Stablecoins usually have lower fees, but always check platform specifics to avoid unexpected costs that could increase your overall bill amount.

How Do Exchange Rate Fluctuations Affect Crypto Utility Payments?

Exchange rate fluctuations can turn your crypto bill payments into a rollercoaster ride. When crypto values change suddenly, the amount you need to pay might be more or less than expected, making budgeting tricky. Stablecoins help smooth out these ups and downs by pegging their value to fiat currency, but volatile coins can still cause surprises. Staying aware of market trends guarantees you’re not caught off guard when paying your bills with crypto.

Is There a Limit to How Much I Can Pay With Crypto?

You can usually pay as much crypto as you want, but limits depend on the platform or service you use. Some might set maximum transaction amounts for security or compliance reasons, especially with large payments. Others allow unlimited payments if you verify your identity and meet certain requirements. Always check your chosen provider’s policies to avoid issues, and guarantee your wallet has enough funds for the total bill.

Conclusion

As you step into the future of bill payments, imagine your crypto funds flowing like a digital river, effortlessly connecting you to your utility providers. With the right platforms and security in place, paying bills with crypto becomes as simple as sending a message. Embrace these evolving tools and watch your financial landscape transform—making every payment feel like a smooth, seamless journey through a world where technology and everyday life meet effortlessly.