To reach the next billion Bitcoin users in emerging markets, focus on improving mobile infrastructure and creating accessible, user-friendly digital wallets. Promote financial inclusion by leveraging stablecoins and streamlining cross-border payments. Supportive regulations and partnerships with local institutions build trust and foster adoption. Tailor strategies to regional economic challenges and tech growth trends. If you keep exploring, you’ll discover how technological advances and inclusive approaches can unleash massive growth opportunities.

Key Takeaways

- Develop tailored regulatory frameworks that build trust and encourage institutional investment in emerging markets.

- Expand mobile infrastructure and digital payment solutions to improve accessibility for unbanked populations.

- Promote financial literacy and awareness campaigns targeting younger and underrepresented demographics.

- Integrate Bitcoin into everyday use cases like remittances, gaming, and microtransactions to boost practical adoption.

- Foster partnerships with local fintech firms and governments to create region-specific products and support infrastructure.

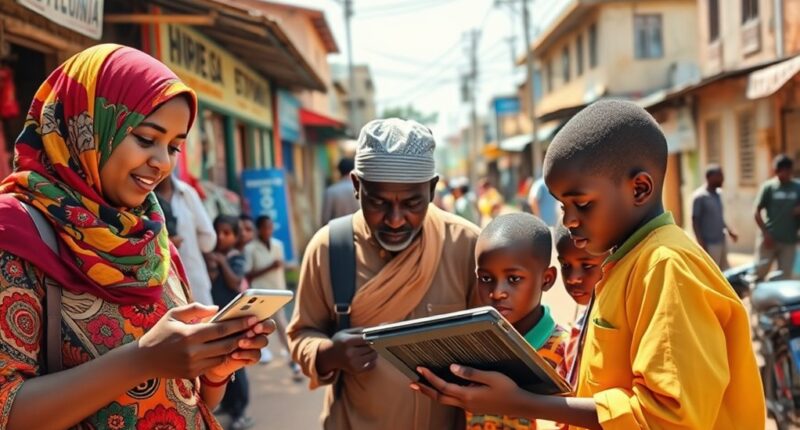

Emerging markets are experiencing a remarkable surge in Bitcoin adoption, driven by factors like high inflation, limited banking access, and rapid mobile technology growth. Over the past decade, Bitcoin’s presence has expanded by more than 18,640%, reflecting a swift embrace of digital currencies in these regions. Countries like India, Nigeria, and Indonesia lead the way, primarily due to widespread mobile wallet use and peer-to-peer transactions that bypass traditional banking systems. By 2030, it’s estimated that around 1.1 billion people worldwide will use Bitcoin, with some countries seeing nearly one in three adults owning digital assets. This rapid growth underscores how Bitcoin is becoming an essential tool for financial inclusion, especially for those in unbanked areas, enabling cross-border payments that were previously difficult or costly. Mobile adoption rates continue to soar, further facilitating access to cryptocurrencies in these regions. Younger generations, particularly those aged 18 to 34, are at the forefront of this shift. Their familiarity with digital technology, along with increasing internet and smartphone penetration, fuels the expansion of crypto activity. As digital natives, they’re more comfortable steering virtual currencies and see Bitcoin not just as an investment, but as a practical solution for everyday financial needs. Furthermore, women are participating more actively, especially in regions like Asia and Africa, helping to narrow the gender gap in crypto adoption. This demographic diversification indicates that the crypto landscape in emerging markets is becoming more inclusive. Economic instability further propels Bitcoin’s growth in these regions. Countries experiencing high inflation turn to cryptocurrencies as a hedge, preserving value when local currencies falter. Additionally, Bitcoin is increasingly used for remittances, thanks to its low transaction fees and rapid processing times, making cross-border transfers more affordable and efficient. In unbanked communities, Bitcoin offers access to financial services that traditional banks often overlook, boosting economic participation. Financial inclusion efforts are vital to expanding adoption and ensuring that more people can benefit from cryptocurrencies. However, regulatory clarity remains a critical factor; clear policies can foster trust and encourage institutional investments, paving the way for broader mainstream adoption. The rise of stablecoins—cryptocurrencies pegged to stable assets—also plays a role, providing a more predictable and secure means of transaction. Technological infrastructure supports this growth as well. Widespread use of mobile wallets simplifies transactions, while the expansion of Bitcoin ATMs and fintech integrations enhances accessibility. In markets like Vietnam, gaming and remittance channels drive crypto use, illustrating how diverse applications fuel adoption. Governments and regulators that develop clear, supportive frameworks can accelerate this progress, making it easier for new users to enter the space. Engaging institutions and creating investment products tailored to emerging markets will be essential for reaching the next billion users. As Bitcoin becomes more integrated into everyday life, these strategies will be critical in transforming the digital currency landscape across emerging economies.

Frequently Asked Questions

How Can Regulatory Environments Impact Bitcoin Adoption in Emerging Markets?

Regulatory environments substantially impact your ability to adopt Bitcoin in emerging markets. Clear, supportive rules encourage you to trust and use Bitcoin, while restrictive or unclear regulations make you hesitant, pushing activities underground. Enforcement actions can either foster innovation or create risks, affecting your access to services. When governments adopt friendly policies, like making Bitcoin legal tender, it becomes easier for you to use and benefit from digital currencies.

What Role Do Local Currencies Play in Bitcoin Acceptance?

Imagine holding a fragile local currency, losing value every day. You turn to Bitcoin, which acts as a lifeline amid this chaos. Local currencies influence Bitcoin acceptance by fueling demand during inflation, making it a stable store of value. They also enable easier conversions with fiat on-ramps, fostering trust. Without strong local currency interaction, widespread Bitcoin adoption struggles to take root in emerging markets.

How Can Education Influence Bitcoin Adoption Among New Users?

You can boost Bitcoin adoption by focusing on education that simplifies its concepts and benefits. When you provide clear, relatable information, you help new users understand how Bitcoin works and its security features, reducing fears. Engaging in community-driven learning and using accessible platforms makes it easier for people to gain confidence. As your knowledge grows, you’ll feel more in control and likely to embrace Bitcoin for savings, remittances, and transactions.

What Are the Main Technological Barriers for New Bitcoin Users?

Think of the digital world as a vast, tangled forest—without a clear path, new Bitcoin users can easily get lost. You face slow transaction speeds, security worries, and complex interfaces that feel like steering through a maze. Limited hardware and inconsistent platforms add to the chaos. These technological barriers can make you hesitant, but with the right tools and support, you can discover your way through and access the potential of cryptocurrency.

How Do Cultural Attitudes Affect Cryptocurrency Acceptance in Different Regions?

You’ll find that cultural attitudes greatly influence cryptocurrency acceptance across regions. In cultures with low uncertainty avoidance, people are more willing to try new technologies like Bitcoin, viewing them as opportunities. Conversely, high uncertainty avoidance cultures tend to resist due to risk concerns. Individualistic societies embrace autonomy and personal control, boosting adoption, while collectivist cultures prefer social consensus. Trust, risk perception, and societal values shape how readily people in different regions adopt cryptocurrencies.

Conclusion

As you consider expanding Bitcoin’s reach, remember that over 60% of people in emerging markets lack access to traditional banking. This creates a huge opportunity for you to drive adoption by providing simple, accessible solutions. By focusing on education, affordable technology, and local partnerships, you can tap into this potential. Imagine empowering a billion new users—it’s not just a goal, but a chance to reshape financial inclusion worldwide.